Financial analysts are scrutinising the Labour Party’s proposed tax adjustments for banks, anticipating a measurable impact on profits.

These fiscal changes, described as a ‘real risk’ by Bloomberg Intelligence, primarily focus on addressing a £22bn deficit, urging strategic responses from key financial institutions.

Potential Impact of Labour’s Tax Plan on UK Banks

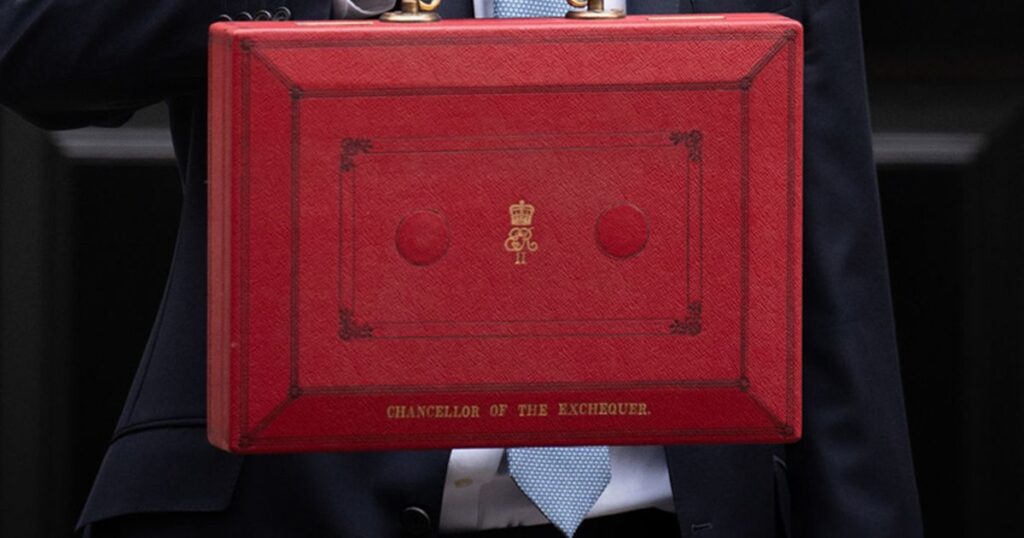

The possible introduction of increased taxation on UK banks has stirred significant concern among financial analysts and stakeholders. According to Bloomberg Intelligence, the Labour government’s proposed fiscal changes, targeting banks in the October Budget, might result in a low single-digit decrease in profits for major institutions such as Lloyds, Barclays, and Natwest. This adjustment is seen as a strategic move to address a £22bn deficit in public finances, termed as a ‘black hole’ by the Labour Party, left by the Conservative government.

Financial experts suggest that although the potential tax changes pose a ‘real risk’, the anticipated impact is deemed manageable for the banks involved. Previous years have seen substantial profits bolstered by rising interest rates, positioning these banks as viable targets for additional tax levies. The profitability surge from high interest rates exemplified by Natwest, which raised its 2024 return on tangible equity (ROTE) guidance by 200 basis points, illustrates the financial robustness and adaptability of these banking giants.

Strategic Responses by Banks

To counteract potential profit setbacks from Labour’s fiscal policies, banks such as Lloyds and Natwest are likely to adjust by repricing loans. This strategic repricing is expected to partially offset the financial impact of higher taxes, maintaining their overarching financial targets.

Analysts project that such strategies will safeguard the banks’ ROTE goals, ensuring that core financial objectives remain unperturbed. Despite the looming tax changes, the foresight and tactical agility exhibited by these institutions reinforce their ability to navigate fiscal challenges effectively.

Governmental Stance and Economic Implications

Recent speeches by government officials have highlighted the prospective tax measures. Prime Minister Keir Starmer mentioned that the forthcoming budget would be ‘painful’, implying significant fiscal adjustments, with those possessing ‘the broadest shoulders’ being expected to contribute more heavily.

Treasury options being considered include increasing the corporation tax surcharge on bank profits. This surcharge, initially introduced in 2016, might see an increment by three per cent as policymakers deliberate the repercussions on monetary transmission and credit supply. Such measures, if implemented, would particularly affect banks with a predominant UK-based business model.

Another financial adjustment under contemplation is the potential doubling of the UK bank levy. This would involve reducing interest remunerations on reserves held by commercial lenders at the Bank of England, a move that could elevate the levy from £1.4bn to an estimated £3bn in the 2024 fiscal year.

Profit Adjustments and Bank Levies

The anticipated tax policy adjustments are expected to directly affect the financial dynamics of major UK banks. Tomasz Noetzel, an analyst at Bloomberg, noted that Lloyds and Natwest, which are heavily focused on UK business, will feel the immediate impacts of any alterations in remuneration for central bank reserves.

Revenue from central bank reserves, which previously made substantial contributions to the earnings of these banks, might face reductions due to the proposed fiscal changes. This expected decrease signifies a shift in revenue streams that banks like Natwest and Lloyds will need to address strategically.

The Broader Economic Impact

The broad economic implications of Labour’s potential tax strategies on banks extend beyond immediate profit adjustments. Banking institutions, having benefitted from high-interest environments, find themselves at pivotal junctures where strategic financial management becomes crucial to sustaining growth.

The planned fiscal corrections seek to rebalance the economic scales, addressing public deficits while challenging banks to innovate and adapt to new financial landscapes. The banking sector’s response to these measures will ultimately dictate its resilience and adaptability in a shifting economic environment.

Industry Overview and Forecast

The UK banking industry, as per financial analysts, remains relatively robust despite the looming fiscal adjustments proposed by Labour. Credit rating agency Moody’s has upgraded the outlook for UK banks from ‘negative’ to ‘stable’, a testament to the sector’s adaptive strategies and anticipated resilience.

Despite the anticipated challenges, the inherent stability in the banking sector, coupled with strategic foresights and robust financial frameworks, positions UK banks to navigate and manage the impacts of potential fiscal challenges effectively.

Concluding Thoughts on Labour’s Proposed Tax Plans

In conclusion, while Labour’s proposed tax adjustments pose notable challenges to UK banks, they also present opportunities for strategic re-evaluation and adaptation. The concerted efforts by financial institutions to mitigate the impact through tactical loan repricing and strategic financial management acts as a testament to their resilience and proficiency in navigating policy shifts.

As these banks brace for potential fiscal changes, their ability to maintain financial targets amidst economic reforms will serve as a bellwether for the broader economic impacts of Labour’s Budgetary measures.

The proposed tax adjustments by Labour present both challenges and opportunities for UK banks.

Their strategic efforts in managing these changes will play a critical role in maintaining financial stability and achieving fiscal targets.