Taxing vices such as tobacco and alcohol is a common governmental strategy to raise funds. However, its effectiveness is waning. The juxtaposition of enhancing public health and generating revenue presents a compelling challenge for policymakers.

Increased taxation often leads to decreased consumption, theoretically benefiting public health, but also triggers a decline in government revenue, creating a fiscal balancing act. At the same time, illegal markets thrive, complicating efforts to regulate and control these industries.

The Fiscal Impact of Vice Taxes

Vice taxes, long seen as reliable revenue streams, including duties on alcohol, tobacco, and gambling, are confronting new challenges. Economic changes and health-conscious shifts have altered consumption patterns, affecting tax revenue. Increasingly, there is a reliance on these levies for funding essential services, but this presents a paradox for policymakers who aim to curtail these habits for public health reasons while still needing the financial input.

The Diminishing Returns of Tobacco Taxation

Recent projections from the Office for Budget Responsibility have shown a significant dip in tobacco revenue, with expectations shrinking from £11.42bn to £8.78bn for 2023-24. This decline marks a critical juncture where health improvements challenge fiscal stability. The reduced revenue comes on the heels of substantial excise increases, illuminating a precarious balance between promoting public health and sustaining government income.

The illegal cigarette market is expanding, driven by higher duties on legal products. This underground economy not only diminishes tax intake but also poses severe health risks, as consumers opt for unregulated and potentially more harmful alternatives. This shift underscores a failing in the current tax strategy, whereby attempts to deter smoking lead to unintended economic and health consequences.

The Shadow Economy and Crime

Increasing taxation on tobacco has inadvertently bolstered criminal activity. Organised gangs are filling the void left by declining legal sales, with estimates of £2.8bn lost in duties and VAT due to illicit trade in 2021-2022. This situation exposes a significant challenge for law enforcement and public policy as efforts to curb smoking inadvertently incentivise illegal markets.

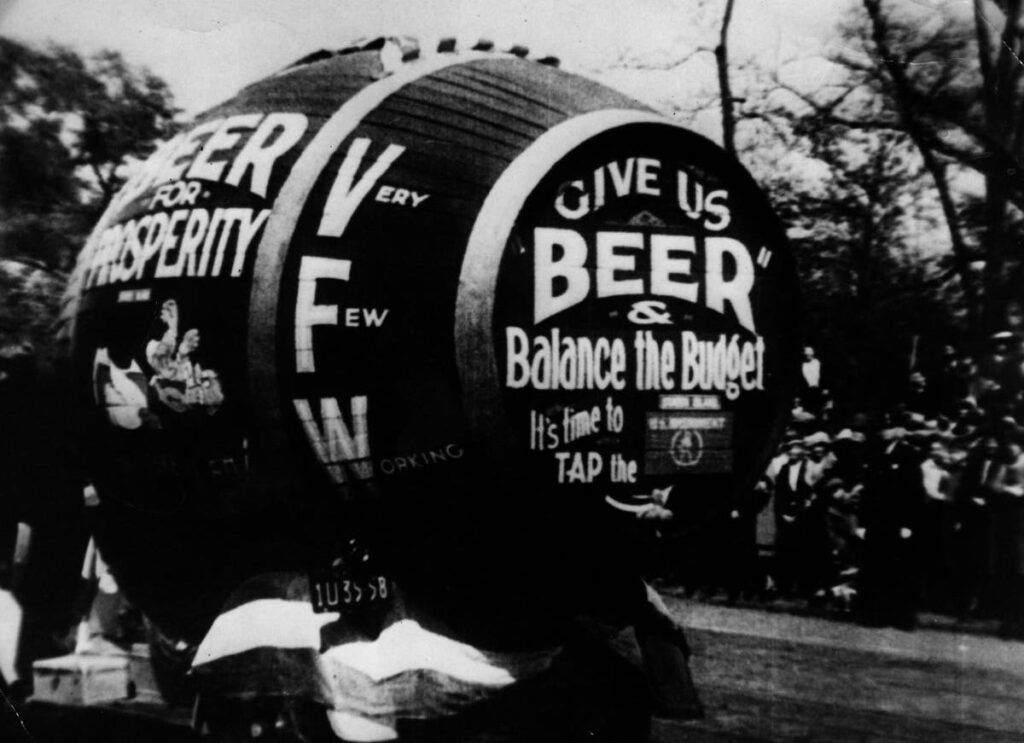

The rise in violence against shopkeepers and thefts is a stark indicator of how vice taxes can have far-reaching effects beyond public health. The push for higher taxes without addressing enforcement gaps invites more sophisticated criminal activities, reminiscent of the era of alcohol prohibition in the United States, which saw the proliferation of unregulated liquor production.

As with historical examples, today’s increase in smuggling and counterfeit products calls for a reassessment of fiscal policies. Without strategic interventions, taxation alone could exacerbate socio-economic issues rather than alleviate them. Effective counter-strategies are needed to mitigate the unintended rise in crime and economic loss posed by these illicit activities.

Balancing Health and Revenue Needs

Policy makers face a dilemma: raising tobacco taxes aligns with health objectives but conflicts with revenue goals, particularly with a £22bn deficit looming. Rachel Reeves, the potential future Chancellor, must navigate these complex fiscal waters carefully. The dilemma centres on whether to prioritise health outcomes or financial stability—a decision with profound long-term implications.

The government is compelled to consider the broader impacts of vice taxes, including public health, crime, and economic factors. Taxation policies that fail to address these interrelated issues may lead to reduced government effectiveness and public dissatisfaction. A comprehensive approach is essential to counteract the limitations of current strategies.

The Future of ‘Sin’ Taxes

The concept of sin taxes now extends beyond traditional vices, with proposals to tax sectors like private education, drawing parallels with traditional sin taxes. The notion is contentious, reflecting broader societal debates about fiscal policy and morality.

As taxes on goods like sugar and petrol become common, assessing their impact on consumer behaviour and government revenues is crucial. The aim is to discourage unhealthy habits while nurturing a sustainable economic model. However, achieving this balance requires nuanced policy-making and careful consideration of unintended consequences.

Future fiscal strategies must encompass a wide range of social and economic factors. It is imperative that the government crafts policies that not only generate immediate revenue but also promote long-term health and social welfare. Success depends on finding a sustainable equilibrium between discouraging detrimental behaviours and maintaining fiscal health.

Strategic Approaches for Sustainable Taxation

To effectively utilise vice taxes, the government must implement strategic measures that consider both public health and economic realities. Enhanced enforcement, investment in prevention, and international cooperation are crucial to dismantle illicit trade networks and uphold the integrity of tax systems.

Innovation in taxation policy could provide novel solutions to existing challenges. Progressive fiscal strategies that focus on reducing demand through education and social reforms could augment traditional tax measures, offering a more sustainable solution to vice-related issues.

Conclusion: Navigating the Financial Trilemma

As Rachel Reeves contemplates future budgetary decisions, the intricate dance between vice taxation and fiscal responsibility continues to evoke critical debate. The need to balance economic necessity with public health imperatives remains a challenging yet essential undertaking for government policy.

In light of these complexities, future strategies must carefully weigh health benefits against fiscal drawbacks. Addressing the underpinnings of vice consumption requires innovative approaches for truly sustainable solutions.