UK property portal Rightmove is currently in discussions with US banks Morgan Stanley and UBS following an unsolicited takeover bid from Rupert Murdoch’s REA Group.

The potential merger, if successful, would notably alter the landscape of the online property market, integrating significant expertise and resources across two continents.

REA Group’s Intentions

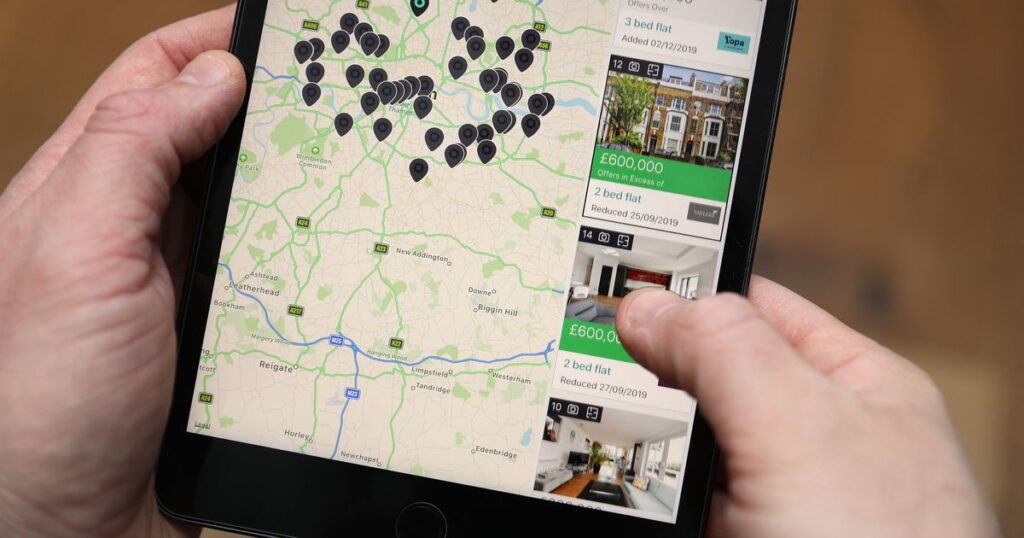

Rightmove has entered discussions with US banks UBS and Morgan Stanley in response to an unsolicited takeover bid from Rupert Murdoch’s REA Group. REA disclosed its intentions in a statement to the Australian Stock Exchange, contemplating a possible cash and share offer for the UK’s largest property portal. Deutsche Bank, Rightmove’s corporate broker, is involved in the discussions despite potential conflicts of interest.

The proposed merger could significantly impact the online property market across two continents. If successful, this would represent the largest outbound transaction from Australia this year. Rightmove’s market value surged to £2.6 billion, following a 27% increase in share prices, the largest daily gain on record. Conversely, REA’s shares fell over five per cent in Sydney following the announcement.

Market Reactions and Shareholder Guidance

REA Group’s board underscored the strategic similarities between REA and Rightmove, noting their leading market positions, continued expansion, and strong brand awareness. The board believes in a transformational opportunity to leverage its globally leading capabilities to enhance value across the combined portfolio.

Analysts have indicated that Rightmove’s subdued ratings, driven by negative sentiment in the UK housing market and competitive threats, may have contributed to its becoming an acquisition target. Rightmove has advised shareholders to refrain from taking any action until a formal offer is made.

Analytical Perspectives on the Takeover

Analysts such as Jessica Pok from Peel Hunt were not surprised by the acquisition target status of Rightmove. The subdued ratings stem from market concerns and competition from entities like CoStar and OnTheMarket.

The potential takeover could enable REA to apply its extensive expertise and create a globally diversified digital property company. This merger aligns with REA’s vision to establish number one positions in both Australia and the UK.

The need for equity raising to finance this ambitious acquisition remains a focal point. Both companies continue to navigate the complexities of this significant potential transaction.

Strategic Implications

Should the merger proceed, it will mark a significant realignment in the online property market. The combination of REA and Rightmove promises to deliver enhanced customer and consumer value, integrating leading capabilities from both firms.

Strategically, this move could place the combined entity in a unique position to innovate and expand in the real estate sector across different regions. This potential market leader could leverage its extensive resources to maintain a competitive edge.

Investor Sentiment and Market Impact

Following the announcement, Rightmove’s shares experienced a historic surge, increasing by 27% and raising the company’s market valuation to £2.6 billion. This investor confidence highlights the perceived potential of the merger.

Conversely, REA’s shares saw a decline of over five per cent in Sydney. This drop reflects investor caution and the potential risks associated with financing the acquisition.

The market’s mixed reactions underscore the complexities and impacts of such major transactions. Both companies are navigating shareholder expectations and financial strategies in the wake of these developments.

Potential Outcomes and Future Steps

The merger’s success hinges on several factors, including regulatory approvals and financing arrangements. A formal offer from REA is anticipated by the end of September.

As both companies work through the negotiation process, the potential for creating a global leader in digital real estate remains a key consideration. The final outcome will shape the competitive landscape of the online property market.

The outcome of these talks will be pivotal in determining the future trajectory of the online property market, with potential advantages for both customer and consumer value.

Stakeholders are keenly observing the developments, anticipating a possible global leader in digital real estate if the merger proceeds.