Raspberry Pi’s shares soared as they made their debut on the London Stock Exchange. This impressive performance has fostered renewed optimism in the UK market. The company is valued at over £750 million, with shares surging by 37%.

Impressive Start

Raspberry Pi’s shares rocketed from a listing price of 280p to 385p on their first day of trading. This 37.2% increase reflects strong investor confidence, valuing the 15-year-old company at over £750 million.

The successful IPO has revived hopes that the UK market can compete globally. Key investors like Arm Holdings and Lansdowne Partners supported the listing with significant investments.

Why the Buzz?

Retail investors will get their chance to trade Raspberry Pi shares soon. The company aims to raise £166 million from this listing.

Employees are set to benefit too, with £68 million allocated for an employee incentive scheme, equating to around £660,000 per worker.

CEO’s Optimism

Eben Upton, the 46-year-old CEO of Raspberry Pi, expressed gratitude for the understanding and support from UK investors.

Upton believes this successful floatation can dispel negative comparisons between the UK and US markets, showing that the UK can hold its own.

The IPO comes at a time when the London Stock Exchange has seen some high-profile exits. Nevertheless, Upton remains confident in the UK market.

Company Background

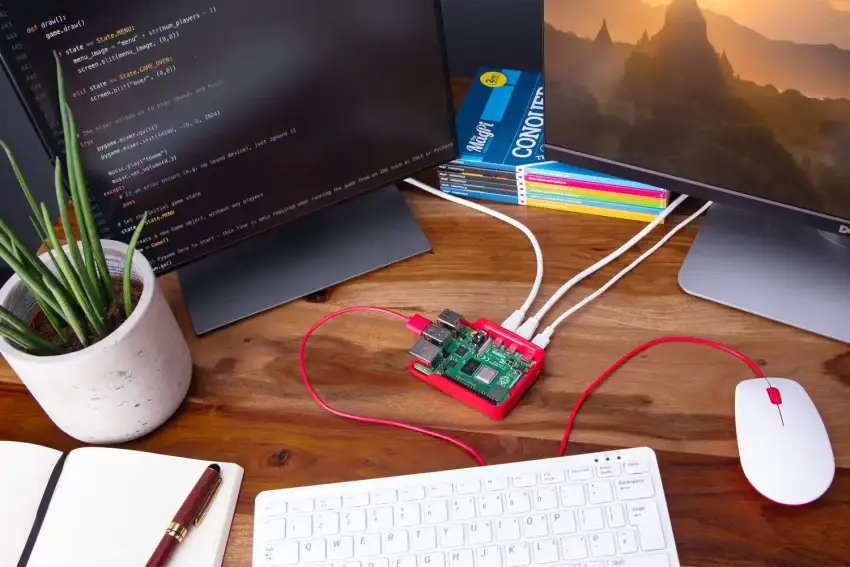

Founded in 2008, Raspberry Pi has grown significantly over the years.

The company started with a vision to inspire young people to take an interest in computer science.

Today, their affordable, credit card-sized computers are used in various applications, particularly in industrial electronics by over 1,300 companies.

IPO Proceeds

The money raised from the IPO will be used for multiple purposes.

These include funding engineering projects, improving the supply chain, and supporting other corporate activities.

Raspberry Pi’s focus remains on innovation and expansion.

Market Implications

Kathleen Brooks, research director at XTB, views this IPO’s warm reception as a positive sign for the London stock market.

She believes it could encourage more companies to consider listing in the UK.

Analysts at Peel Hunt have also highlighted the broader market impact, suggesting it could boost confidence in the City’s IPO market.

Future Prospects

The UK’s improving economic outlook, coupled with strong performances in banking, mining, and energy sectors, is expected to support the IPO market.

Other companies like Klarna, Waterstones, and Starling Bank might consider IPOs, buoyed by these improving conditions.

Despite challenges, such as low valuations and liquidity issues, Raspberry Pi’s successful float shows that the UK market holds promise for tech companies.

Raspberry Pi’s successful IPO is a positive development for the UK stock market. It not only boosts investor confidence but also paves the way for more tech success stories in the future. The strong market response highlights the potential and resilience of the UK’s financial landscape.