Revolution Bars Group, based in Ashton-under-Lyne and operating 65 premium bars and gastro pubs, has announced the appointment of entrepreneur Luke Johnson as its non-executive chairman. This follows the retirement of Keith Edelman, who served as chairman since 2015. Earlier this month, the group completed a restructuring plan involving new share subscriptions, including a £12.5 million placement with shareholders such as Johnson, turnaround investor Rebus, and three existing shareholders.

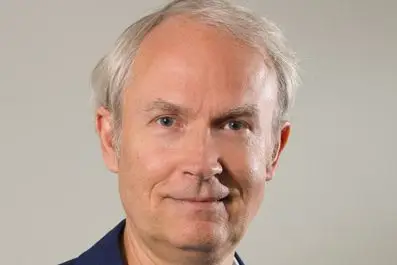

Luke Johnson, known for his significant impact on the hospitality sector, will now hold 300,000,000 ordinary shares, representing 20% of the company’s ordinary shares. Johnson’s storied career includes his role as chairman and investor in PizzaExpress during its rapid expansion in the 1990s, as well as his involvement in Gail’s bakeries. Despite his successful ventures, Johnson was also chairman of Patisserie Valerie during its 2019 collapse due to significant fraud.

CEO Rob Pitcher expressed gratitude for Edelman’s leadership through various challenges, including an IPO, the pandemic, and recent restructuring. Pitcher expressed enthusiasm for Johnson’s vast hospitality experience, which is expected to contribute significantly to the group’s future development.

Meanwhile, EG Group’s co-founder and CEO Mohsin Issa provided a trading update for the second quarter of 2024. The group’s underlying EBITDA increased by 12%, driven by strong performances in the USA and Europe. In the USA, strategic initiatives boosted EBITDA by over 25%, while strong fuel performance in Germany led to a 10% increase in Europe. Proceeds from selling the group’s 216 KFC franchise restaurants and the upcoming sale of its UK forecourt business are expected to repay debt.

Pebble Group, a specialist in corporate promotions based in Trafford Park, reported strong operational progress in the first half of 2024 despite a 4% revenue decline to £60.8 million and a 6% reduction in pre-tax profits to £2.9 million. The group continues to enjoy excellent customer retention and a solid balance sheet. Significant capital investment is being funded by generated cash, supporting growth and increasing shareholder returns.

Furthermore, Together Financial Services, based in Cheadle Hulme, has successfully priced its £445 million 1st charge-only residential mortgage-backed securitisation (RMBS), known as TABS12. This marks the third RMBS for the group this year, emphasising its robust business model and strong investor support.

Altrincham-based healthcare property group has appointed Steven Noble as Chief Investment Officer, a new role aimed at bolstering the group’s short and long-term growth strategy. Noble brings extensive experience from his previous roles and will be instrumental in implementing the group’s investment strategy across all healthcare markets.

These developments highlight the dynamic nature of the North West business landscape, with significant appointments and strategic moves aiming to secure growth and stability in challenging markets.