The business landscape in the North West is experiencing notable developments, with significant updates from key players.

This round-up highlights the recent activities, financial results, and strategic decisions of companies such as Surface Transforms, Frenkel Topping, OTAQ, PRS REIT, Huddled, and Kelso, providing insights into their current performances and future prospects.

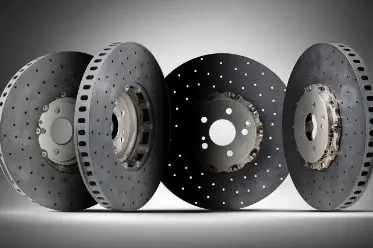

Surface Transforms Faces Revenue Challenges

Surface Transforms, the specialist brakes manufacturer, has adjusted its full-year forecasts due to missed growth targets. CEO Kevin Johnson reported that despite achieving new highs in output and revenues in 2024, the growth pace is substantially behind expectations. Q3 revenues are expected to be significantly lower than planned, leading to a revised full-year revenue forecast of £11m, down from £17.5m.

Johnson highlighted operational inefficiencies and cash constraints as significant impacts of the slowed growth. He indicated that while output and revenue improved post-H1, with volumes doubling in Q3 compared to Q2, the overall growth rate remains below expectations. The company raised over £9.5m in an open share offer in May and secured a £13.2m local authority loan for capital expenditure.

Despite these challenges, Surface Transforms saw a 58% increase in revenues to £4.7m for the half-year period ending June 30, 2024. However, the pre-tax loss widened to £7.6m compared to a £5.6m loss the previous year. Johnson noted that the delays in enhancing capacity and yield improvement projects are key factors in the slower growth pace.

Frenkel Topping Sees Mixed Financial Results

Frenkel Topping, the specialist financial and professional services firm based in Salford, reported mixed unaudited interim results for the period ending June 30, 2024. Turnover increased from £16m in 2022 to £17.9m, amid a 15% rise in funds under management (FUM) to £1.455bn. However, pre-tax profits declined from £2.428m to £1.741m. Cash and cash equivalents were also down, standing at £4.1m compared to £4.9m the previous year.

CEO Richard Fraser expressed satisfaction with the group’s ability to drive FUM growth. He pointed out that the acquisition of Northwest Law Services Limited has performed well since its completion in April 2024. Fraser acknowledged that 2024 had its challenges, particularly for Partners in Costs Limited (PIC), where expected growth was not achieved. Nevertheless, Fraser remains hopeful for PIC’s medium-term prospects.

OTAQ Struggles with Revenue and Losses

Marine technology group OTAQ, based in Lancaster, reported a decline in revenues and an increase in pre-tax losses for the six months to June 30, 2024. Revenues fell to £1.510m from £1.801m a year ago, with pre-tax losses rising to £884,000 from £773,000. Despite these setbacks, the company launched its Live Plankton Analysis product commercially and signed its first customer contract during the period.

Post-report, OTAQ raised £1.79m through Convertible Loan Notes and offered an additional £1m broker option available until the end of 2024. The firm also fulfilled a £350,000 connector order in July and implemented cost-saving measures expected to deliver annual savings exceeding £500,000. CEO Phil Newby highlighted the company’s focus on new markets and cost reductions as key strategic priorities.

PRS REIT Achieves FTSE 250 Listing

PRS REIT, which manages a vast portfolio of family homes in the private rented sector, has joined the FTSE 250 Index. The trust’s current portfolio boasts over 5,400 homes, primarily located across major regions of England, excluding London. The company expects to complete its portfolio, totaling approximately 5,600 homes with an estimated rental value of £66.5m, by the first quarter of 2025.

Chairman Steve Smith termed PRS REIT’s entry into the FTSE 250 Index a significant achievement, attributing the success to the support of stakeholders, including investors and housebuilder partners. Smith emphasised the acute shortage of quality rental housing in the UK and highlighted PRS REIT’s role in pioneering a new approach to delivering modern family homes at scale.

Huddled Sees Revenue Growth Amidst Losses

Ecommerce business Huddled, listed on AIM, reported a rise in revenues for the first half of 2024, driven by the acquisition of Nutricircle. Revenue for the period reached £5.274m, with Q2 2024 alone delivering £3.130m, a 46% increase compared to Q1 2024. Despite this, the group posted an adjusted EBITDA loss of £1.550m, attributed to the costs of expansion and investment.

CEO Martin Higginson outlined H1 2024 as a period focused on investment and growth. He expressed confidence in future growth, supported by recent acquisitions such as Nutricircle and Boop Beauty, which have expanded the company’s ecommerce portfolio. Higginson highlighted the importance of continued revenue growth and operational efficiency in achieving a profitable and sustainable business model.

Kelso Reports Interim Losses

Kelso, the activist investor, presented interim results showing non-cash unrealised losses of £0.9m, mainly due to the decline in THG shares. Despite this, Chairman Sir Nigel Knowles expressed confidence in Kelso’s ability to meet its target internal rate of return (IRR) of 25%.

Knowles also announced Kelso’s plan to seed its first acquisition vehicle, Selkirk Group Plc, which will focus on single company acquisitions and is expected to list on the AIM market. He expressed gratitude to shareholders for their ongoing support.

The recent financial updates from prominent North West companies highlight varied performances amid challenging market conditions. Surface Transforms and OTAQ have faced revenue declines and increased losses, while Frenkel Topping and Huddled have shown growth in specific areas despite overall profit declines.

PRS REIT’s FTSE 250 listing marks a significant milestone, and Kelso remains optimistic about its strategic investments. These developments underscore the dynamic nature of the region’s business landscape, with companies continuously adapting to market demands and pursuing growth opportunities.