The United Kingdom is teetering on the brink of a significant exodus of tech talent to the United States. Nigel Toon, the co-founder of Graphcore, a major UK chipmaker recently acquired by Japan’s SoftBank, has sounded the alarm. Toon highlights the lack of support from British pension funds as a critical issue. This shortage of funding could drive talented individuals and innovative startups to seek opportunities abroad.

Foreign investors, particularly from the US, are stepping in to fill the funding gap. However, this comes with its own set of challenges. Toon warns that these investors might require UK startups to relocate to secure the necessary investment. This scenario not only threatens the vital skills and innovation within the UK but also raises concerns about the long-term sustainability of the country’s tech sector.

Lack of Domestic Investment

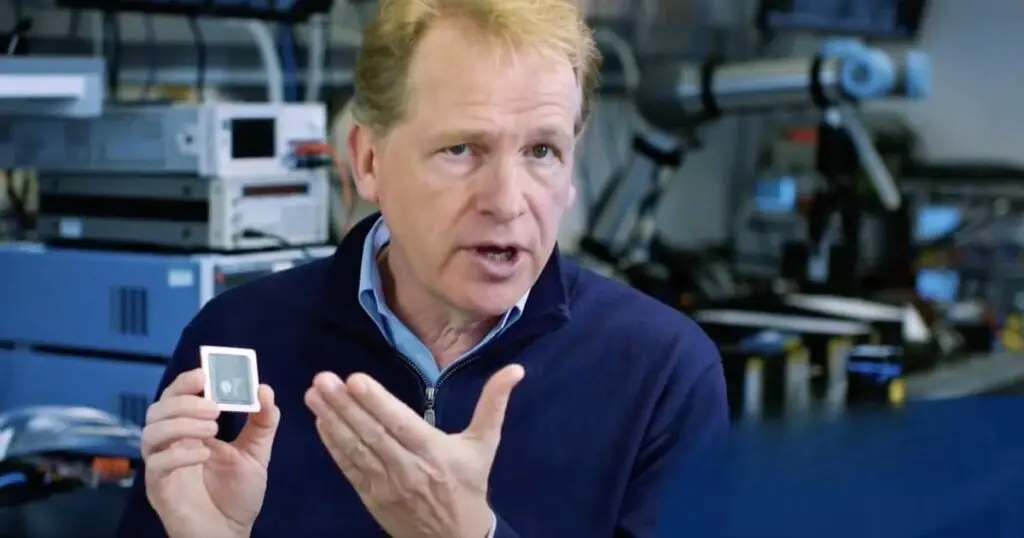

Nigel Toon, the co-founder of Graphcore, a UK-based chipmaker recently acquired by Japan’s SoftBank, has expressed concern over the insufficient support from British pension funds for domestic private businesses. “They’re certainly not investing in private companies here in the UK,” he remarked. Toon emphasizes that without these “pools of capital,” businesses cannot grow unless they seek funding from other sources. This lack of domestic investment is a significant barrier for British tech companies looking to expand.

The shortage of local support means that UK tech talent may be attracted by foreign investors who can offer the necessary growth funding. Toon warns that US-based venture capital firms might require British startups to relocate across the Atlantic to secure investment. This potential “talent drain” could see some of the UK’s brightest minds moving abroad, depriving the domestic tech industry of vital skills and innovation.

Impact of Foreign Investment

Despite these challenges, Britain has been making strides in artificial intelligence, largely due to significant foreign investment from major US tech companies like Microsoft, Meta, and Google. Toon acknowledged this progress but pointed out the irony that while the country excels in AI, it relies heavily on foreign capital. For instance, Google acquired the UK-based AI company DeepMind in 2014, illustrating this trend.

The sale of Graphcore to SoftBank is expected to bring substantial investments into the UK, with Toon predicting that this deal “is probably going to end up bringing billions in investment in AI to the UK.” He added that Graphcore plans to expand its 350-member workforce and build a “very substantial AI engineering effort.” Such investments could potentially offset some of the negative impacts of the talent drain.

Graphcore’s Challenges and Opportunities

Last year, Graphcore faced significant hurdles, warning that there was a “material uncertainty” regarding its survival and the need for fresh funding by May 2024. Peter Kyle, the secretary of state for science, innovation, and technology, referred to Graphcore’s difficulties while supporting the SoftBank deal, stating it was a “welcome end to the uncertainty that has faced Graphcore and its employees.”

Graphcore is not alone in its challenges; it is the latest in a series of UK tech companies to be acquired by SoftBank. Previously, SoftBank purchased the Cambridge-based chip designer Arm for £24bn in 2016 and remains its largest shareholder after the company’s New York listing last year.

SoftBank has been actively investing in UK tech, recently leading a $1bn investment in the British self-driving technology startup Wayve. These investments underscore the growing interest of foreign entities in UK technology, providing much-needed capital but also highlighting the domestic sector’s reliance on international funding.

The Demand for AI Technology

The rapid growth of AI technology has created a massive demand for computing power to train and operate AI systems. Graphcore develops chips known as intelligence processing units (IPUs), which are crucial for training and running AI models. These chips are essential components behind AI systems like OpenAI’s GPT-4.

The high demand for such technology has significantly boosted valuations in the industry. For example, Nvidia, a market leader in AI chips known as GPUs, has seen its valuation soar to over $3tn. Toon commented on the potential for competition in this space, stating that the goal is not to replace Nvidia but to provide choice and foster the development of new types of AI.

He also expressed confidence that Graphcore could emerge as one of the “two or three” major players in the AI chip market. “Can we be one of those other players sitting alongside Nvidia? Absolutely,” Toon affirmed. This optimism reflects the potential for growth and innovation within the industry, despite the challenges faced.

Strategic Collaborations

SoftBank has recognized the importance of next-generation semiconductors and compute systems in the quest for artificial general intelligence (AGI), systems with human-level capabilities. Vikas J Parekh, a managing partner at SoftBank Investment Advisers, expressed enthusiasm for collaborating with Graphcore on this mission, stating, “We’re pleased to collaborate with Graphcore in this mission.”

The Financial Times reported that the value of the SoftBank-Graphcore deal is estimated at $600m. This valuation is a stark contrast to Graphcore’s valuation of $2.8bn at the end of 2020. This decline highlights the financial difficulties the company faced, which included cutting its workforce by a fifth and closing operations in several countries.

Despite these challenges, Graphcore continues to operate from its base in Bristol, with additional offices in Cambridge, London, Gdańsk in Poland, and Hsinchu in Taiwan. The company’s continued presence in these locations underscores its commitment to maintaining a strong foothold in the global tech industry, even as it navigates financial challenges.

The Future of UK Tech

The future of the UK tech sector heavily depends on the availability of investment, both domestic and foreign. The ongoing involvement of foreign investors like SoftBank provides critical funding but also raises questions about the long-term independence and growth of UK tech companies. The challenge lies in balancing foreign investments with the development of robust domestic funding sources.

UK tech companies must navigate a complex landscape to thrive, requiring strategic collaborations, substantial investments, and a solid talent pool. The potential talent drain to the US remains a significant concern, emphasizing the need for increased domestic investment to retain top talent and foster innovation.

The next few years will be crucial in determining whether the UK can establish itself as a leading hub for tech innovation or remain reliant on foreign funding. The outcome will significantly impact the country’s economic growth and its position in the global technology landscape.

In conclusion, the lack of domestic investment is a major concern for the UK tech industry. The potential “talent drain” to the US could jeopardize its progress. While foreign investments offer short-term relief, they may not be the long-term solution. The UK must bolster its own funding sources to ensure a sustainable and innovative tech sector.