Budget computer firm Raspberry Pi has revealed that its profits were stronger than expected in its first update since floating on the London stock market earlier this year. Shares in the company, whose computers are made in Wales, saw a significant rise in early trading as a result.

The Cambridge-based company raised £178.9 million in an initial public offering (IPO) in June. This has been a substantial boost to the London Stock Exchange, which had seen a dearth of new listings in the past year. Recently, the company was added to the FTSE 250 index.

The newly public Raspberry Pi informed its shareholders that revenues had surged by 61% to £107.9 million over the six months ending June 30, compared with the same period the previous year. This impressive growth was largely attributed to the strong uptake of its latest product, the Raspberry Pi5.

Raspberry Pi now expects higher unit volumes for the second half of this year, fuelled by new product launches. This shift in profitability expectations indicates a robust market demand for their innovative products.

Upton also praised the company’s extraordinary team and world-class product portfolio. He emphasised the exciting future roadmap and a loyal and engaged customer base.

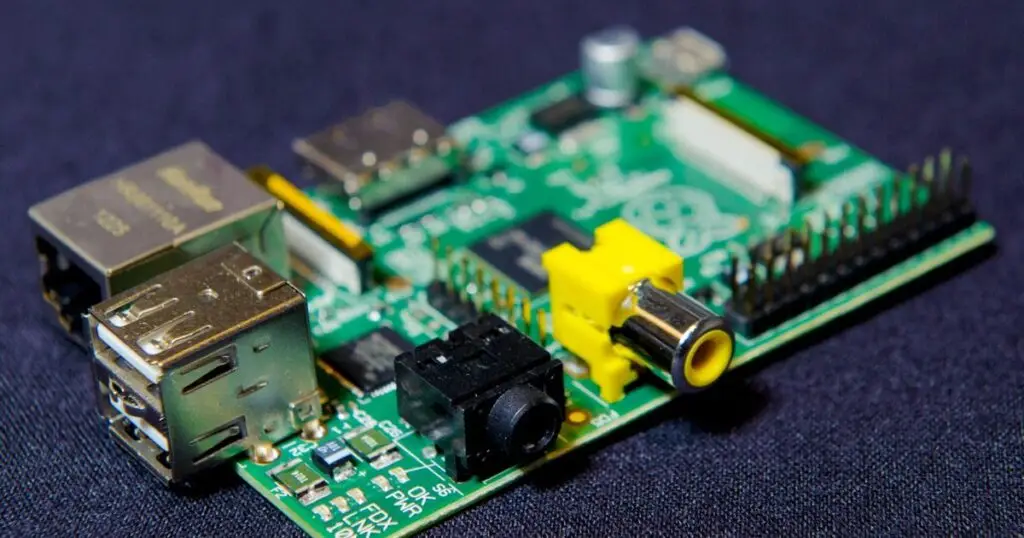

Since the commencement of production at Pencoed, Raspberry Pi has sold over 60 million of its single-board computers. This milestone underscores the widespread popularity and trust in the brand.

The solid revenue figures and optimistic outlook reflect Raspberry Pi’s capacity to continue its upward trajectory. The company is well-positioned to leverage new product launches and heightened consumer demand in the upcoming quarters.

Raspberry Pi’s growth story illustrates the potential for tech companies to achieve substantial gains through innovation and strategic market positioning. Their achievements set a precedent for aspiring tech enterprises.

The stronger-than-expected profits posted by Raspberry Pi following its flotation marks a significant milestone for the company. It showcases a robust performance and a promising future outlook, underpinned by strong product uptake and strategic market moves.

As the company continues to innovate and expand its product line, it sets a noteworthy example in the tech industry. Raspberry Pi’s successful transition to a public company and its impressive financial results provide a source of encouragement for the tech sector at large.