The property website Zoopla achieved profitability in its latest financial year, with sales surpassing £90m. Documents submitted to Companies House reveal that Zoopla transitioned to a pre-tax profit of £18.7m for the year 2023, recovering from a pre-tax loss of £6.2m in the previous year, as reported by City AM.

During this period, Zoopla’s revenue increased from £87.2m to £90.4m. However, the company’s average headcount saw a reduction, decreasing from 483 employees to 388. Despite this reduction in workforce, the board remains optimistic about the company’s future prospects.

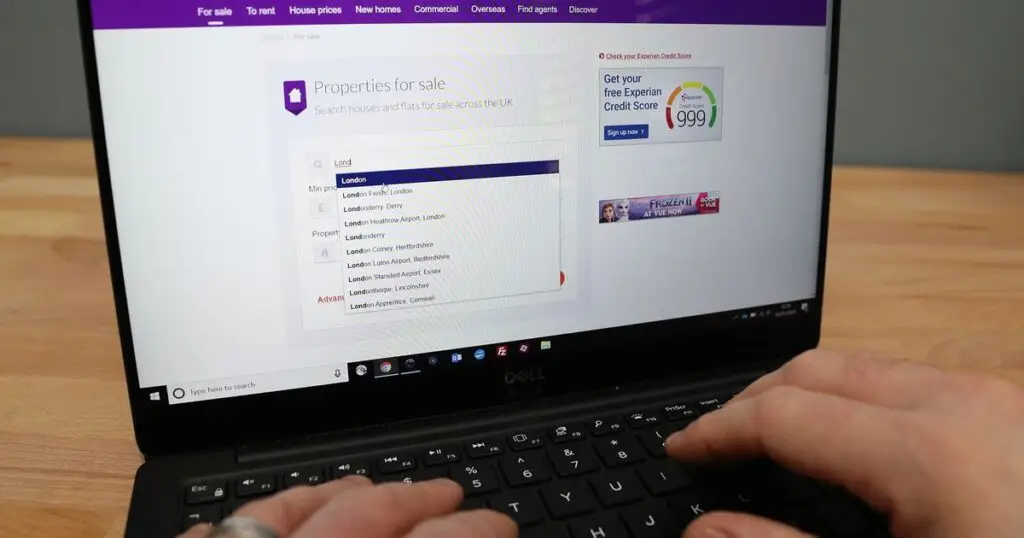

In a statement, the directors conveyed their confidence in Zoopla’s sustainability, citing its position as the UK’s most comprehensive property website. They stated, “The directors believe that Zoopla is a sustainable business that can build on its position as the UK’s most comprehensive property website, helping consumers research the market and find their next home by combining hundreds of thousands of property listings with market data and local information.”

Moreover, the company is committed to maintaining its status as the top platform for property-related decisions by continually innovating and improving its product offerings. The board emphasized that the goal is to enhance both consumer and partner experiences continually.

Meanwhile, Zoopla’s parent company, which also operates platforms like Confused.com and Uswitch, reported a significant reduction in pre-tax losses by nearly £600 million in 2023. The parent company disclosed a pre-tax loss of £134.9m for its most recent financial year, a substantial improvement from the £714.6m loss reported in 2022. The group’s revenue also saw an increase, rising from £391m to £451.5m during the same period.

Silver Lake Partners owns the group, which includes brands such as Primelocation, Money.co.uk, Tempcover, Hometrack, Alto, and Calcasa in the Netherlands. This diversified portfolio indicates a robust business model with multiple revenue streams, contributing to the overall financial health of the parent company.

Zoopla’s return to profitability, coupled with the significant reduction in pre-tax losses by its parent company, signifies a positive trajectory for the organisation. The focus on sustainability and innovation suggests that Zoopla is well-positioned to consolidate its leadership in the property market while continually enhancing user experience.